While COVID-19 has meant tremendous economic hardship across all business sectors, executives widely feel employees have risen to the occasion regarding productivity as a result of much of the country utilizing a work-from-home (“WFH”) model. Furthermore, most of these business leaders will continue to let their employees work remotely after widespread application of a coronavirus vaccine. Those are a pair of key findings from EisnerAmper LLP’s executive survey, which gauged the outlook of business leaders throughout the United States.

Many of the key findings from the Summit survey foreshadow where and what the “future of work” may look like. Here are the survey’s findings:

Company Footprint

- 60% of respondents will let staff continue to work remotely post-pandemic. Only 8% will not let employees work virtually, and 32% are undecided.

- Due to their positive experience with an expanded virtual work platform, a majority (55%) of respondents are more likely to increase the hiring of contractors or out-of-state employees.

- 50% will not downsize or will add space; 29% are unsure; 21% will downsize to some degree.

Salary and Benefits

- As a result of the pandemic and WFH, 23% expect to utilize a new type of salary structure; 44% expect salary structure to remain the same; and 33% are undecided.

- 40% of employers have not added mental health benefits due to expanded WFH; 16% have added such benefits.

- The majority of employers (59%) have not or do not plan to add benefits for WFH parents with children who are remote learning; 12% have added such benefits.

Operations

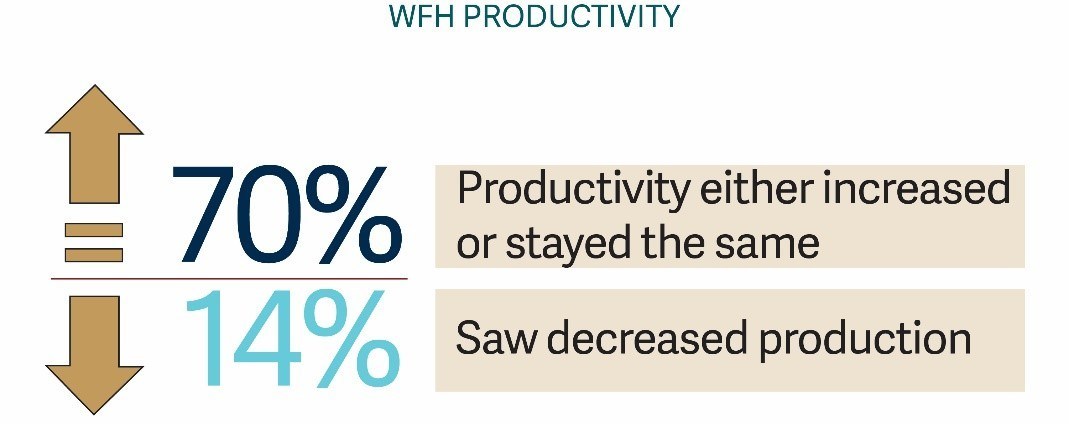

- 70% of respondents said productivity either increased or stayed the same in a virtual work setting; 14% saw decreased production; 16% were unsure.

- Lack of team building was cited as employers’ biggest challenge managing a virtual workforce (54%); technology challenges were ranked a distant second at 18%.

- 68% do have a business continuity plan in place; 32% do not.

- Over the next year, companies plan to make investments in tech (63%); staffing (43%), and training (34%). Interestingly, last year’s EisnerAmper Summit survey found cybersecurity was a major concern, yet this year found cybersecurity investment for 2021 ranked fourth at 30%.

- Roughly two-thirds (64%) of responding companies plan to stay with the same supply chain, while 36% are considering alternative sources.

“Our annual Summit continues to provide a wealth of helpful data on what business executives are thinking and feeling, along with the corresponding trends,” said EisnerAmper CEO Charly Weinstein. “As we start to see the light at the end of the tunnel regarding the pandemic, it’s clear that many companies will combine the practices of their ‘old normal’ with business practices of the ‘new normal.’ EisnerAmper stands ready to help them meet their evolving challenges head-on.”

Methodology

The survey was taken by 273 business owners, C-suiters, family office executives, and high-net-worth individuals who attended EisnerAmper’s National Business Summit held virtually on December 2.

The bulk of attendees (54%) are in financial and professional services, with representation from other sectors such as health care, technology, manufacturing, not-for-profit and real estate. Most companies fall in the annual revenue range of $50 million to $500 million.