The death of retail has been greatly exaggerated as evidenced by TD Bank’s Retail Experience Index – a biannual survey that tracks consumers’ purchasing habits, focusing on big-ticket items of $500 or more.

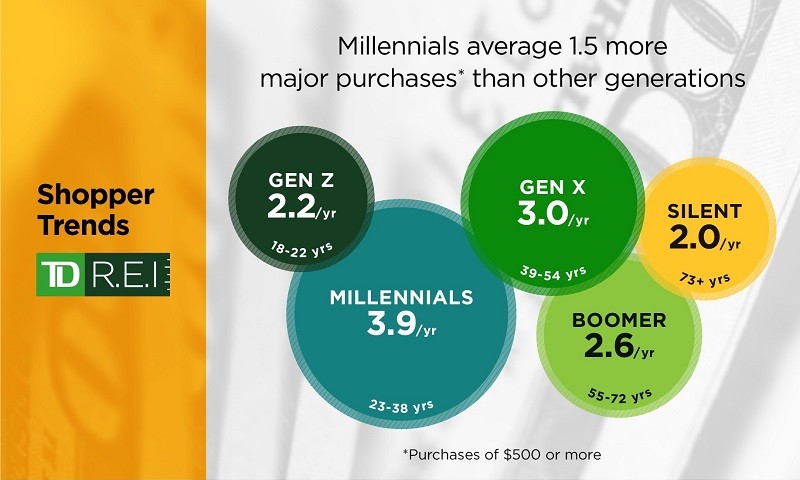

Spending is up and a surprising generation is driving this financial injection. According to our survey, millennials made more major purchases in the last year and are the generation most likely to make another major purchase in the next six months. Millennials made, on average, nearly four major purchases in the past year, while Gen X and baby boomers combined averaged just 2.8 major purchases during that time.

“Retailers should take notice, as millennial purchasing habits are driving the retail world,” said Mike Rittler, General Manager of Retail Card Services, Personal Lending and Business Development at TD Bank.

While millennials are leading the way in increased spending, growth is happening in other areas, according to the survey. As we compare today’s numbers to 2017:

- Americans are spending $245 more per major purchase than they did in 2017, averaging a $1,884 price tag on their last major purchase.

- Nearly seven in ten Americans (69%) say they plan to make a large purchase in the next six months, up 10% from two years ago.

Millennial Shoppers Move the Economic Needle

Although much has been made about millennials not buying homes or saving for the future, they are making more major purchases than any other generation. In fact, they spent slightly more on their last major purchase than both Gen-X and baby boomers.

Millennials are also taking advantage of retail store cards. While the average overall number of retail cards held is about two and a half, millennials hold nearly three cards (2.9). They’re also purchasing more than their older counterparts with these cards. Gen X and baby boomers use retail credit cards 1.8 and 1.3 times per month, respectively, while millennials use their cards 3.1 times per month.

Survey data also indicates that millennials are extremely thoughtful about these major purchases.

- They spend more time, on average, researching major purchases (4.4 hours) than any other group

- Millennials are more likely (39%) to research financing options than their elders (22%)

- Millennials are more likely to research financing in-store (64%) than older generations (44% of Gen-X and 49% of baby boomers)

“The myth that millennials aren’t out there putting money into the economy is just that: a myth,” Rittler said. “Millennials are a discerning and price-conscious set of consumers, and while it may not be easy to earn their business, retailers should take notice. Improve the customer experience, focus on digital sales options and incorporate strategies and programs geared towards engaging with millennial shoppers. Millennials are letting their wallets do the talking and successful retailers will conform to how this segment wants to shop.”

Loyalty Remains the Secret Sauce

Brand loyalty is also the secret to this retail success. Satisfied retail card holders spend more than nonengaged customers, nearly $700 more on average for a major purchase than those without a card.

Additionally, more than half (57%) of Americans are creatures of habit, often picking the same brand when making major purchases. With regard to customer retention, 69% of consumers are members of a retailer loyalty program and cite that cash back and discounts are the most appealing and useful rewards.

“Capturing and retaining engaged customers will continue to be an essential part of retailers’ strategy. As consumer’s shopping habits evolve and the factors that drive customer loyalty change, it’s important that retailers work with partners who will help them analyze data and behaviors to create new programs that cater to their customer bases across generations, preferences and levels of income,” Rittler said.

Survey Methodology

The study was conducted by research company Maru/Matchbox. Respondents were composed of a targeted panel sample of 998 Americans who participate in holiday shopping. A random sample of this size would have a margin of error of +/- 3.1 percent. The data was weighted by age, gender and region to reflect the national population. The online survey was fielded from September 25 to October 1, 2019.