Vision health is essential to living life to the fullest. If you neglect to get the assistance you need, you can struggle to see, which puts a strain on your eyes or can cause dangerous situations when driving, for example. When you have children, poor eyesight can result in difficulty learning because they cannot see the board.

These are a few reasons why vision health and coverage is critical for overall health. Vision insurance isn’t always linked with your general health insurance. It can be a little confusing but don’t worry. We’re going to tell you all you need to know about eye insurance plans.

Traditional

Vision insurance plans are broken into two categories, traditional and alternative. A traditional program works like a regular health insurance plan. You’ll pay a premium, deductible, and copays. You’ll add eye coverage to the health coverage you already have, and they’ll work in the same way.

Health Maintenance Organization Plan

In a Health Maintenance Organization Plan, you’ll need a primary care doctor with specialists who work within the network. First, you’ll need your primary care physician to refer you to an eye specialist to stay covered.

They’ll do this if you fail your eye exam during your annual physical. You won’t be covered by insurance, if you go to the eye doctor without their referral.

Preferred Provider Organization Plan

If you want a little more freedom with who your eye doctor is, you should look into a Preferred Provider Organization Plan. You can choose an out of network specialist and still receive coverage.

However, the coverage will be higher than with an in-network eye specialist.

Indemnity Plans

These plans are reimbursement plans. You’ll receive the eyesight care you need and pay out of pocket for everything. Then, you’ll file a claim with documentation on what you’ve paid for.

Depending on the claim and the necessity of vision care, the insurance company will reimburse you for the money. It could be the full amount or a part of it.

Alternative

Alternative vision insurance means you’re a part of a discount program. You don’t have traditional health insurance from a job and can’t afford a plan out of pocket.

If you know you have eye problems or have a family, it’s vital to have some coverage, even just a little. You have to pay a monthly or yearly fee for vision insurance, but it will be discounted.

When you need to go for eye exams or checkups, you’ll have a pool of doctors you can choose from that are covered. These are usually discounted services, but it’s better than nothing.

What Does Vision Insurance Cover?

Vision insurance works like health insurance in that you’ll receive financial support for a variety of things to keep you healthy. These can be anything from checkups to emergency procedures.

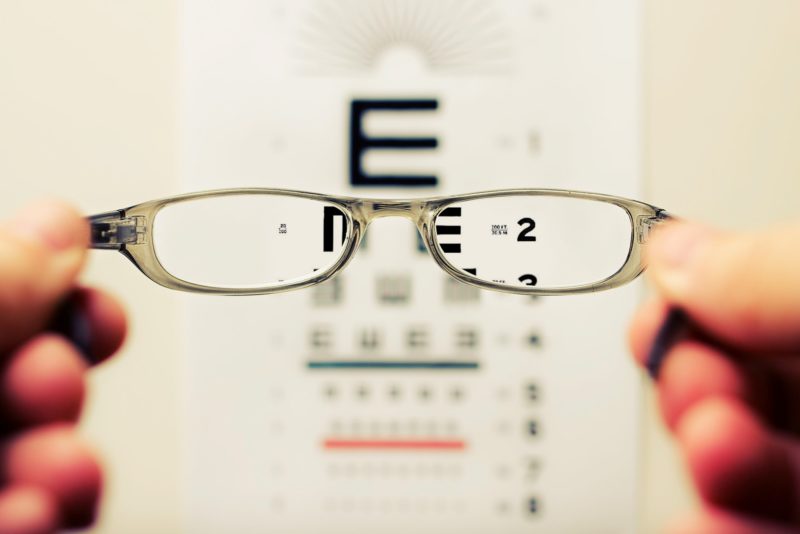

Eyesight insurance covers eye exams, which are done annually. During this exam, the doctor will test your vision, color blindness, peripheral sight, and look for vision problems or diseases. Our eyes are always changing, so even if you had perfect eyesight for years, it could start to decrease.

You’re covered when you need glasses or contact lenses. Without coverage, these things can be expensive. Some insurances will only cover one or the other, while others cover both. Prescription sunglasses may be included with your plan, as well.

Insurance will cover the cost of surgeries. They can be an emergency or planned. You might need an emergency procedure if you have an injury or infection. There are other planned surgeries like LASIK that could be covered or not. Some insurance providers deem this as cosmetic.

Do I Need Vision Insurance?

If you’re a young single person who has had excellent eyesight all their lives, you could get away without having vision insurance. However, you still want to go to your annual physicals and have your doctor check your eyesight. Once your doctor expresses concern, then you should invest in coverage.

On the other hand, if you’ve a family, you need eye insurance. You never know if your children will need to visit an eye doctor, which can cost a lot out of pocket. If you have a family history of vision problems as you age, you might want to consider getting protection.

It’s always better to be covered and never use it than find yourself in a tight financial situation because of vision health.

The Bottom Line

Eye health is a part of overall health. You and your family should be able to view the world clearly and with ease.

Ask your health insurance provider if you can add on vision protection to your plan. If not, you can purchase an alternative method that will provide you with essential eyesight needs. Vision insurance covers eye exams, glasses, contacts, and surgeries. It’s critical to have if you have a family or a history of vision problems.

Author Bio:

About Michelle Joe: Michelle Joe is a blogger by choice. She loves to discover the world around her. She likes to share her discoveries, experiences, and express herself through her blogs. You can find her on Twitter, LinkedIn, Facebook